Instagram stories and glossy brochures promise effortless pura vida income. Yet many condominiums sold to overseas buyers in Costa Rica are financial traps waiting to spring. The single biggest problem is that homeowner associations rarely keep meaningful reserve funds. When a major repair appears the entire cost falls on the people who own the units.

If your goal is long term value cash flow or even basic peace of mind you must treat most Costa Rica condos as non investable until proven otherwise.

HOA RESERVES THE MISSING SAFETY NET

In the United States and Canada regional statutes oblige associations to maintain audited reserve accounts. Costa Rica offers no comparable legal requirement. Law 7933 allows but does not mandate reserves and there is little governmental follow up. Boards therefore keep what they wish which is often very little. CostaRicaLaw dot com notes that after an expense is approved payment becomes mandatory for every owner regardless of size. CostaRicaLaw.com

Why this matters

• Major systems such as roofs elevators pools and perimeter walls all have finite service lives in a salt laden tropical climate

• Without reserves every large project triggers an extraordinary fee that may reach five or even six figures per unit

• Owners who cannot pay risk liens or court ordered sales

SPECIAL ASSESSMENTS THE BUILT IN TIME BOMB

Browse any expat forum and you will spot threads about unexpected bills to waterproof balconies or repave common drives. The Tico Times warns that condo fees can double or even triple once an HOA begins real costing and that extra assessments are common for items not covered by monthly dues. Tico Times

Common triggers include

• Structural wear in concrete and rebar spalling from constant salt exposure

• Mechanical failures of pumps generators and aging elevators

• Insurance shortfalls after storms or earthquakes when premiums jump faster than boards can adjust budgets

A buyer who focuses only on the asking price forgets that ownership means unlimited liability for common area breakdowns.

THE OVERSIGHT VOID HURTS FOREIGN BUYERS MOST

Local residents can attend meetings speak Spanish fluently and lobby for higher dues before disaster strikes. Foreign owners often visit only a few weeks per year and rely on managers or short term rental hosts for updates. Because Costa Rica does not enforce annual audits or public filings boards may postpone maintenance for many years. When problems finally surface resale values collapse and the most remote owners feel the pain first. CRIE points out that condominium bylaws set voting thresholds but do not guarantee transparency which leaves the burden of due diligence on every buyer. CRIE

RED FLAGS THAT DEMAND AN IMMEDIATE WALK AWAY

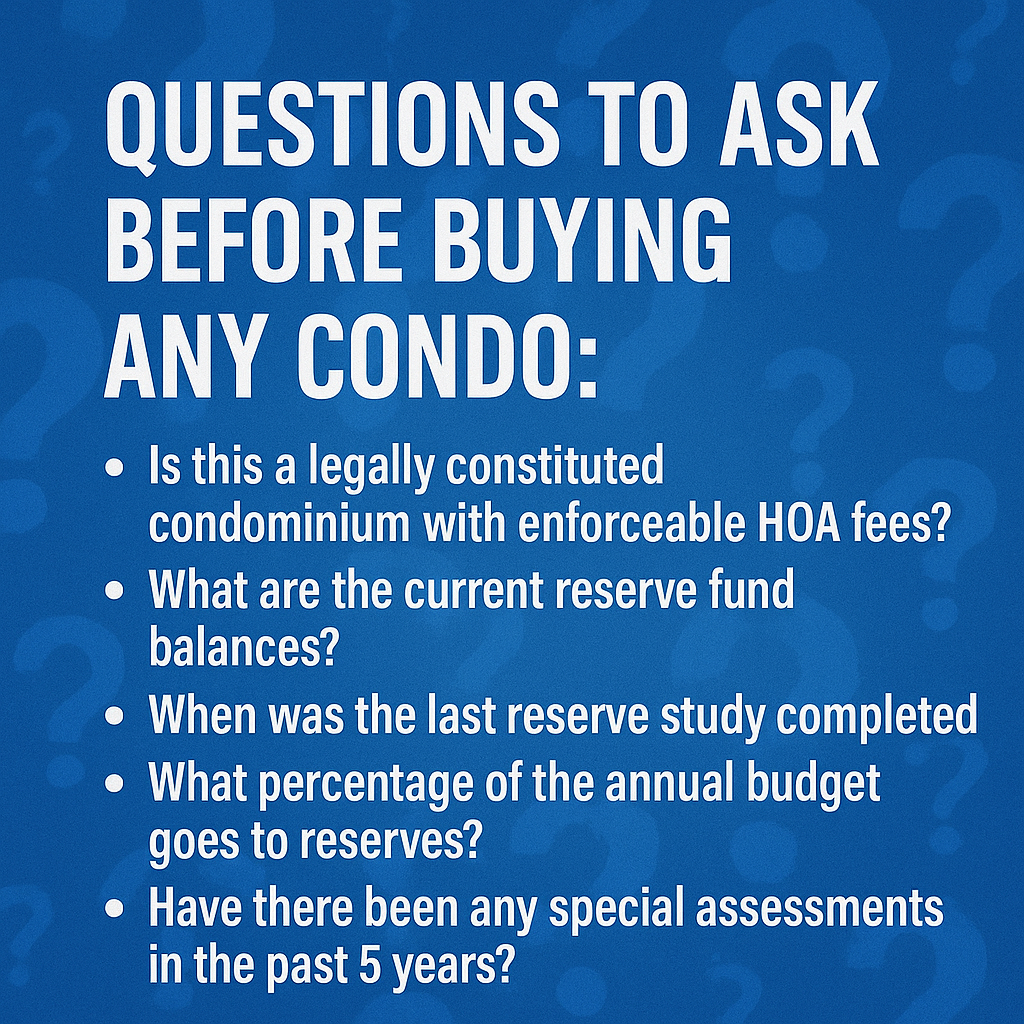

Use this checklist during the very first viewing. If any item appears stop the transaction and keep looking.

• No independent reserve study within the past three years

• Monthly dues unchanged for five or more years even though inflation and labor costs keep rising

• Developer or a related company still controls board decisions long after the last unit closed

• Building age above fifteen years with no record of major replacements

• Visible neglect such as cracked tile peeling paint or out of service amenities

• Board reluctance to supply full financial statements and prior meeting minutes

Remember silence and delay are also answers. If a broker says the documents are coming but cannot show them quickly assume they hide bad news.

FINDING THE TRUE RISK ADJUSTED PRICE

A listing may look cheap against North American equivalents yet the posted number rarely reflects total cost. Adjust it with three straightforward steps.

- Ask an engineer for a life cycle report on roofs waterproofing elevators drainage and retaining walls

- Estimate your share of unfunded projects then subtract that figure from the offer price

- Reduce the remainder by an additional liquidity discount because units inside under funded buildings attract fewer qualified buyers and many banks decline to lend

If projected assessments plus reserve gaps equal more than ten percent of the offer your capital is safer elsewhere.

ACTION PLAN FOR CURRENT OWNERS

You may already own a Costa Rica condo. In that case

• Demand an independent reserve study and make it available to all stakeholders

• Vote for dues that cover the recommended savings target even if payment hurts now

• Hire an external accountant every year to audit cash flow and balance sheets

• Keep detailed maintenance records and share them with insurers since clear documentation often secures better premiums

DUE DILIGENCE ROADMAP FOR PROSPECTIVE BUYERS

Follow these steps before placing any deposit.

• Visit the building in person and walk every stairwell mechanical room and roof deck

• Attend at least one homeowner meeting to observe board culture and openness

• Search the property name together with words such as assessment lawsuit or lien in both English and Spanish

• Retain separate legal and engineering professionals who represent only you not the seller

• Request the last three years of financial statements budgets and minutes within forty eight hours If the response is partial or delayed withdraw immediately

ARE ANY CONDOS INVESTABLE

High quality complexes do exist though they are uncommon and usually command higher prices. Seek these minimum standards.

• Audited reserve balance that meets or exceeds the ten year capital plan

• Documented pattern of preventive maintenance rather than reactive patch jobs

• Owner controlled board with published minutes and open voting

• Transparent insurance program that shows current valuations and deductibles

• Clear completion of past large projects without lingering debt or litigation

In such communities the premium you pay is offset by lower long term volatility and easier resale.

THE COMING SHAKE OUT

First wave projects built in the early two thousands are now reaching the age when concrete repairs elevators and waterproofing all peak simultaneously. Climate trends show stronger storms and heavier rainfall. Insurance carriers respond by raising premiums or dropping policies when they see thin reserves. Under funded associations will face a crossroads.

• Raise monthly dues sharply and hope all owners can pay

• Defer maintenance further which accelerates physical decline and drives values downward

Both paths penalize late arriving investors the most.

CONCLUSION PROTECT YOUR CAPITAL BEFORE CHASING THE VIEW

Costa Rica remains a wonderful place to live retire or place part of your portfolio provided you verify the fundamentals. For condominiums audit level transparency and healthy reserve accounts are not optional extras. When they are missing even the prettiest ocean view may conceal an unlimited liability.

Final rule Treat every condo as guilty until it proves innocence through clear documents and solid cash cushions. If transparency is weak or the math fails walk away and rent on the beach instead. Your wallet and your peace of mind will thank you.

-

🚨 COSTA RICA CONDOS AT MOST RISK FOR FOREIGN BUYERS

Our first blog entry explained why most Costa Rica condominiums are non investable until they prove otherwise. This second entry drills deeper. Certain building profiles carry…

-

🚨 WARNING MOST COSTA RICA CONDOS SHOULD BE CONSIDERED NON INVESTABLE FOR FOREIGN BUYERS

Instagram stories and glossy brochures promise effortless pura vida income. Yet many condominiums sold to overseas buyers in Costa Rica are financial traps waiting to spring.…

-

Strategies for Sellers to Maximize Value in Costa Rica

This paragraph dives deeper into the topic introduced earlier, expanding on the main idea with examples, analysis, or additional context. Use this section to elaborate on…

-

The Hidden Costs of Buying Property in Costa Rica

Buying property in Costa Rica can be an exciting investment, but it’s essential to be aware of the hidden costs that might not be immediately obvious.…

-

Key Trends Shaping Costa Rican Real Estate in 2023

This paragraph serves as an introduction to your blog post. Begin by discussing the primary theme or topic that you plan to cover, ensuring it captures…

-

Analyzing the Best Locations to Invest in Costa Rica

This paragraph serves as an introduction to your blog post. Begin by discussing the primary theme or topic that you plan to cover, ensuring it captures…

Leave a Reply